-

Consumers asked banks in 2024–2025 to reduce the costs of ongoing loans

- Feb 26, 2026

- In Press releases

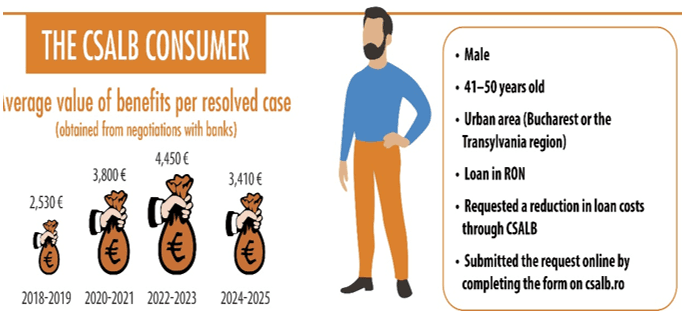

The last two years have brought significant changes in the profile of consumers who turn to the Center for the Alternative Resolution of Banking Disputes (CSALB). The analysis of the 6,434 negotiation requests sent to CSALB in 2024 and 2025 shows that the typical consumer of financial-banking services is a man from an urban area, mainly from Bucharest or central Transylvania, aged between 41 and 50, who has a consumer loan in lei and who asks the bank, through an application filled in directly on the website csalb.ro, for a reduction in the costs of the ongoing loan. The average benefit obtained in 2024–2025 from each negotiation was EUR 3,410.

-

CSALB: 96% of negotiations in 2025 ended in amicable settlement, in an average time of only 13 days

- Jan 28, 2026

- In Press releases

Negotiations between consumers and banks reached last year the highest acceptance rate of the solutions proposed by conciliators of the Center for the Alternative Resolution of Banking Disputes (CSALB). In 96% of the requests submitted by consumers and accepted by banks, the reported issues were resolved and the parties reached an amicable agreement outside the courts. In 2025, negotiations took place in an average time of only 13 days, the shortest average duration since the establishment of CSALB. The total value of the benefits resulting from negotiations in 2025 amounted to EUR 3.22 million.

-

How do consumers negotiate with banks after their cases reach court? 800 lawsuits settled amicably

- Dec 10, 2025

- In Press releases

The mission of the Alternative Dispute Resolution Center in Banking (CSALB) has evolved over the past 10 years: from a platform for amicable dispute resolution, helping parties avoid court altogether, into an entity that also resolves disputes already pending before the courts. In recent years, 800 lawsuits that had already been initiated in court were resolved through conciliation within CSALB. At the recommendation of judges, at the proposal of the bank, or at the initiative of consumers, parties involved in litigation may request (before or after the first court hearing) the identification of a fair, fast, and cost-free solution for consumers within CSALB. The highest number of requests aimed at ending court proceedings through CSALB come from the counties of Cluj, Mureș, Alba, and Harghita.

-

10 Banking Fraud Methods and Channels: What Consumers Report to CSALB

- Oct 29, 2025

- In Press releases

In recent months, the Alternative Banking Dispute Resolution Center (CSALB) has received dozens of complaints related to banking channel fraud. In each of these cases, consumers turn to banks for help recovering their lost money. Unfortunately, in most fraud cases, the funds stolen by cybercriminals quickly disappear, being repeatedly transferred through multiple bank accounts and/or payment institutions. So far this year, in only eight cases of fraud have banks accepted consumers’ requests and entered the CSALB conciliation process. In these exceptional situations, banks refunded part of the stolen amounts, on the condition that the money be returned to the bank if the police manage to recover the damages.

-

10 Years of CSALB. From Initial Distrust to Thousands of Successful Negotiations and Millions of Euros in Benefits

- Sep 24, 2025

- In Press releases

This September marks 10 years since the establishment of CSALB (the Alternative Banking Dispute Resolution Centre), created through Government Ordinance 38/2015. The consumer–bank negotiations intermediated by CSALB conciliators and resolved amicably (outside of court) have significantly contributed to restoring trust in the banking system, according to representatives of the National Bank of Romania and the Romanian Banking Association. Over the 10 years since the founding of the Alternative Banking Dispute Resolution Centre (CSALB), the number of lawsuits between consumers and banks has dropped from more than 40,000 to around 12,000. Although in the early days both banks and their clients were skeptical about the effectiveness of conciliation, in 10 years, consumers of financial products and services submitted more than 20,300 requests for negotiations with banks and NBFIs.

-

Can Robots Handle Conciliation? Artificial Intelligence is Revolutionizing the Romanian Banking System

- Aug 27, 2025

- In Press releases

The banking industry is facing a new revolution—digitalization and artificial intelligence. Banks are increasingly using robots for repetitive, time-consuming activities such as drafting contracts, sending replies, or interacting with consumers in call centers. Robots can draft documents to be submitted in court or even anticipate the outcome of a trial. In the near future, Artificial Intelligence will provide consumers with product recommendations based on client profiles. For now, however, robots are constantly assisted by humans. Banks are implementing AI in their internal processes, but when it comes to the final consumer, caution still prevails, say the guests of the podcast organized by the Alternative Banking Dispute Resolution Center (CSALB).

-

Forced Execution: Court Trials or Negotiation with the Bank? Amicably Settled Enforcement Files at CSALB

- Jul 09, 2025

- In Press releases

Delayed loan payments may put consumers at risk of forced execution. If the unpaid debt reaches a judicial officer (bailiff), they may seize bank accounts and wages, initiate the forced sale of movable or immovable property (depending on the debtor’s assets), and charge the consumer with all enforcement-related costs. These costs include the executor’s, lawyers’, and appraisers’ fees, notifications, summonses, addresses sent to banks for account garnishment, and transportation expenses. The best strategy for consumers in this situation remains dialogue with the bank—directly or through CSALB. This recommendation was made during a podcast hosted by the Alternative Banking Dispute Resolution Center (CSALB).

-

How Much Should You Save to Be Financially Secure? Expert Recommendations

- Jun 18, 2025

- In Press releases

Saving is one of the most important indicators of societal well-being and the financial health of every family. The money we set aside can provide us with comfort in times of crisis, security during retirement, and even the ability to generate passive income through investments. When investing, it is essential to carefully choose financial instruments and properly assess risks. What are the most effective saving methods? How much of the family income should be secured? These questions were addressed in a podcast organized by the Alternative Banking Dispute Resolution Center (CSALB).

-

Emotional Manipulation, Increasingly Used in Fraud Attempts Targeting Romanians’ Bank Accounts

- May 28, 2025

- In Press releases

The digitalization of payments and artificial intelligence represent real opportunities for the development of the banking system, but they are also among the main business areas targeted by cybercriminals who threaten the safety of our money. Banking frauds through phishing, spoofing, and emotional manipulation are becoming more frequent, and individuals with little experience using new technologies are the most targeted victims, according to fraud prevention specialists. Complex schemes used to deceive consumers include luring users into fake investments and installing applications that allow criminals to remotely take control of bank accounts. All these issues are among the topics discussed in the podcast produced by the Center for Alternative Dispute Resolution in Banking (CSALB).